Contents:

Knowing the ledger number makes it easy to cross-reference. Acts as both; in the journal and ledger, the closing balance of it is directly transferred to the trial balance. The balance in the cash book is updated and verified continuously and it is recorded in chronological order. I would love to give 5 stars for such a wonderful app.

This cash book means records the amounts of the cash receipts and cash payments. If cheques are received and immediately sent to bank for collection, it should be treated as bank transaction and so the amount should be posted on the debit of bank column. However, if cheques are received but endorsed in favour of other, then it should be posted on the debit of cash column on receipt and on the credit of cash column on endorsement. Mistakes can be easily found by verification, and entries are kept up-to-date as the balance is checked daily. For cash accounts, balances are usually reconciled at the end of the month after the monthly bank statement is released. Entries without a discount column are transferred to the relevant ledger in a general manner as in a single column cash book.

- Accounting students can take help from Video lectures, handouts, helping materials, assignments solution, On-line Quizzes, GDB, Past Papers, books and Solved problems.

- In case a transaction affects both the cash and the bank account, a contra entry is recorded.

- The actual date on which the cash was received is listed on the debit side in the first column and the actual date on which the cash was paid is listed on the credit side.

- The difference represents actual cash in hand and should tally with the amount in the cashier’s hand.

- BooksHere we have an additional column for the discounts.

Entries are then posted to the corresponding general ledger. Maintaining cash books can help prevent labor and time loss.Cash security can be ensured as the cash balance of the cash book must be reconciled with the cash balance of the fund. On the other hand, all cash transactions are primarily recorded in the Cash Book in order of date and thereafter posted to the concerned ledger accounts.

Entries in the cash book are then posted into the general ledger. As soon as cash transactions are completed, they can be recorded directly in the cash book without entering the journal book. As a result, a business organization can find out the amount of its cash on a daily basis.

Importance of Cash Book

The single column cash book uses one column on each side of the cash book. The column records either the receipt of cash on the left hand side , or the payment of cash on the right hand side . Before talking about the cash book, we would briefly explain what is cash. Cash is a current asset which consists of items used in day to day financial transactions as medium of exchange. In accounting and finance, cash includes currency notes made of paper, coins, demand deposits, money orders, checks and bank overdrafts etc.

- When money is received, it is recorded in the cash book as a debit.

- In a smaller business that experiences less transactional volume related to cash, all cash transactions are recorded within a single cash book.

- The difference will mean so much balance at the bank.

- The bank reconciliation statement is prepared that helps to reconcile the two books as a measure of internal auditing.

- It is similar to the chequing account kept in the logbook.

However, its cash column and bank column acts like cash account and bank account in which the direct posting to trial balance is possible, so it is a principal book also. A cash book and a cash account differ in a few ways. A cash book is a separate ledger in which cash transactions are recorded, whereas a cash account is an account within a general ledger. A cash book serves the purpose of both the journal and ledger, whereas a cash account is structured like a ledger.

तीन खाने वाली रोकड़ बही क्या है ( What Is Three Column Cash Book )

Double column cash books will show things like bank transaction details. The double-column cash book contains two money columns both on the debit and the credit sides. One column is for the transactions related to the cash, and the other column is for the transactions related to the business’s bank account. So, under the double-column cash book, the business also records cash transactions and transactions through the bank. But on the other hand, the transactions on credit are not recorded while preparing the double column cash–book.

The amount of the transaction is recorded in the final column. Since all cash transactions are recorded in one place in the cash book, it is not difficult to obtain any information about the cash transaction in the future. Another important feature of the cash book is that the cash transactions are recorded in it transferred directly from the cash book to their relevant Ledger account. Business cash receipts and payments are known easily.

The difference between the total of the two sides gives cash in hand or bank account balance. It is said from the above discussion that the features mentioned above are shown in the Cash Book. Its balance can be transferred directly to the trial balance. In order to prepare the final account, it is not necessary to record a ledger called a cash account individually. Cash transactions are recorded in a cash book or a special book, i.e. a cash book, without being recorded in a journal book.

There are a few different types of cash books which all work slightly differently. The next section of this article will discuss more about each one. A cash book is a type of journal used to track the transactions between a business and its bank.

What Are the Two Components of a Cash Book?

They are recorded in different books depending on the nature of the transaction. Cash transactions are usually recorded in the cash book. Matching − Actual cash in hand and cash book balance are verified, so errors and recording mistakes are minimized.

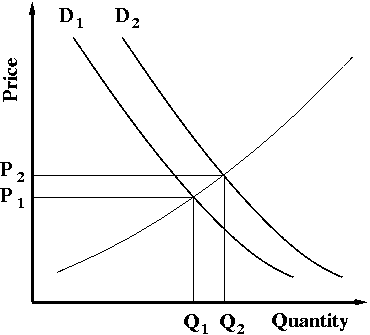

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Price-to-book (P/B) ratio as a valuation multiple is useful for value comparison between similar companies within the same industry when they follow a uniform accounting method for asset valuation. While the book value of an asset may stay the same over time by accounting measurements, the book value of a company collectively can grow from the accumulation of earnings generated through asset use.

The cash book is a chronological record of the receipts and payments transactions for a business. In two parts, a cash receipt journal and a cash disbursement journal. So that cash receipt and cash payment transactions are recorded separately. The firm usually has cash transactions which are happening in all the departments. The cash transactions are then recorded in one of the above formats of the cash books.

Written-down value is the value of an asset after accounting for depreciation or amortization. A company’s market value will usually be greater than its book value since the market price incorporates intangible assets such as intellectual property, human capital, and future growth prospects. Value investors look for companies with relatively low book values (using metrics like P/B ratio or BVPS) but otherwise strong fundamentals as potentially underpriced stocks in which to invest.

It is a snapshot of customer’s account in the bank’s book. With the help of pass book, banks inform their customer about the status of their account. The balance of cash in a cash book can be recorded in 2 ways. Among the different types of maintaining a petty cash book or a full-fledged one, the three types are as discussed below. The cash book is recorded in chronological order, and the balance is updated and verified on a continuous basis. It is therefore essential that the organization monitors the liquidity situation and preserves the cash book in order to know the amount and consequences of the cash transactions.

In reality, if a separate cash book is kept, no need to include a cash flow in the journal. A cash flow statement is viewed as a chequing account for several reasons. The cash disbursements journal – Cash Disbursement Journal records all the cash payments and the cash receipts journal, which helps in recording the cash received into the business. The cash disbursement journal consists of such items as payments payable to vendors, which is done to reduce the accounts payable. The cash receipts journal consists of the payments that are made by the customers on the outstanding accounts receivable or the cash sales.

From the above discussion it appears that the Cash Book is the substitute for the Cash Account. In fact, no separate Cash Account is opened in the Ledger, Cash Book serves the purpose of the Cash Account. The entries in Cash Book are regarded as one aspect of the Double Entry System – the other aspect is posted to the Ledger in the concerned account. The information in a cash book is entered in chronological order, which makes it easier to research transactions at a later date.

SM Energy: Not A ‘Premier’ Operator (Neither A Compelling … – Seeking Alpha

SM Energy: Not A ‘Premier’ Operator (Neither A Compelling ….

Posted: Tue, 28 Mar 2023 11:47:27 GMT [source]

Cash records are essential for a firm since their proper care and verification of financial records are critical. For simplicity, the single cash ledger book diagram below shows only one side of the cashbook, in this case the left hand, receipts side . The right hand, payments side would be identical in structure and format. The closing balance of the bank column is regularly cross-checked with the bank’s closing balance.

Normally the https://1investing.in/ will have receipts recorded on the left hand side and payments recorded on the right hand side . There is no need to prepare a separate cash account. This is done in order to manage cash efficiently which makes it easier to determine cash balances at any point whenever necessary. This allows the company heads or the company accountants to keep a systematic record to budget their cash. In any other ledger account, there is no Voucher No. column, instead there is Journal Folio column.

Also known as a simple cash book or a one column cash book, a single column cash book has one relevant column on each side which shows the simple “receipts” and “payments” of cash. Receipts are shown on the left side and the right side is for payments. A Cash Book is a type of subsidiary book where cash bank receipts and cash bank payments made during a period are recorded in a chronological order. Receipts are recorded on the debit – the left hand side, and payments are recorded on the credit – right hand side. In a treble column cash book, there are three money columns on both sides for recording transactions relating to cash, bank, and discount. On the other hand, cash payments are recorded in the cash column of the credit side, and payments through cheques are recorded on the debit side.